42 how to calculate a bond's coupon rate

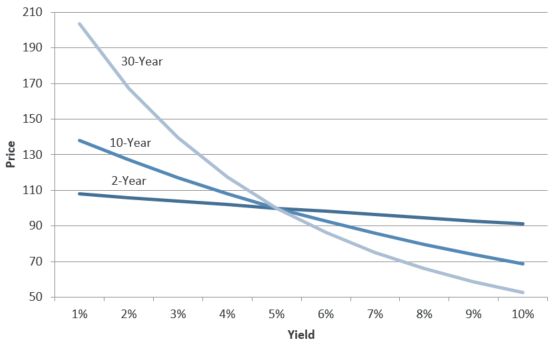

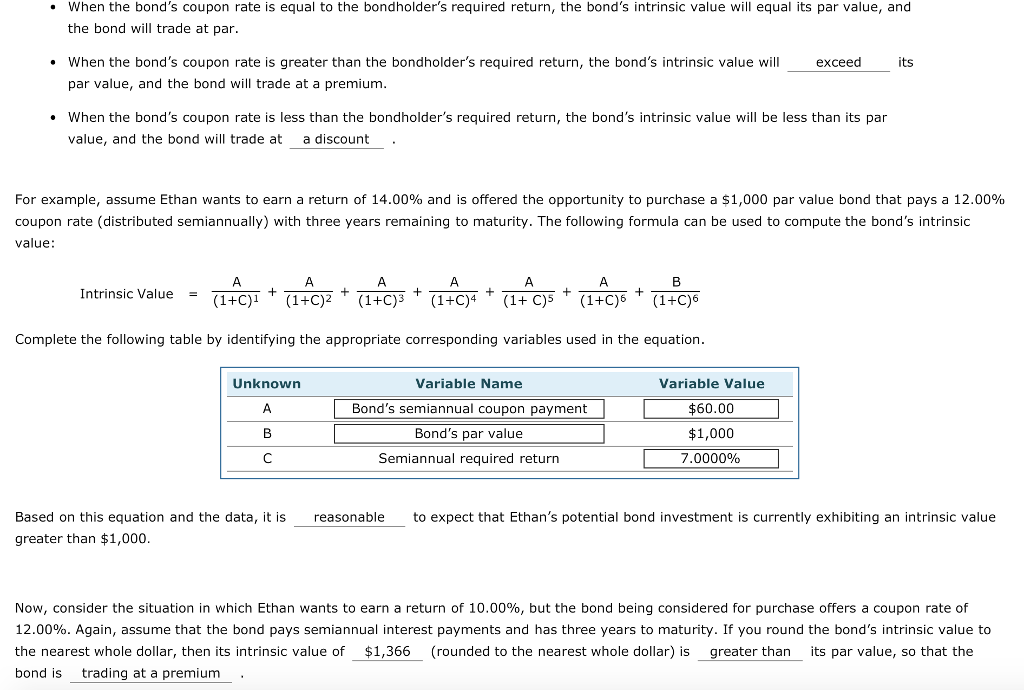

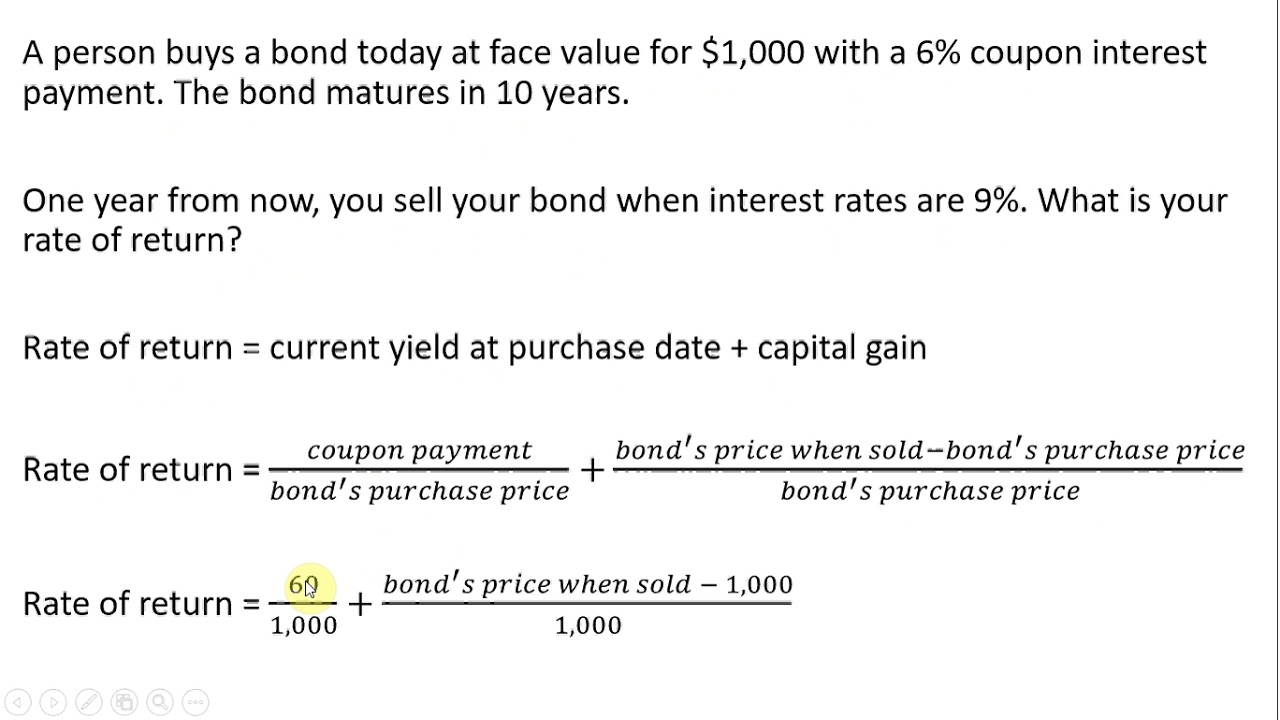

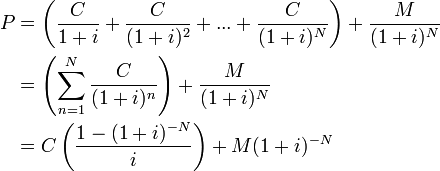

› Calculate-a-Coupon-PaymentHow to Calculate a Coupon Payment: 7 Steps (with Pictures) Aug 02, 2020 · To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] › articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's coupon rate is the periodic distribution the holder receives. ... In addition, the discount rate used to calculate the bond's price increases. For these two reasons, the bond's price ...

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Steps to Calculate the Bond’s Coupon Rate The steps to calculate the coupon rate of a bond are the following: Firstly, the face value or par value of the bond issuance is determined as per the funding requirement of the company.

How to calculate a bond's coupon rate

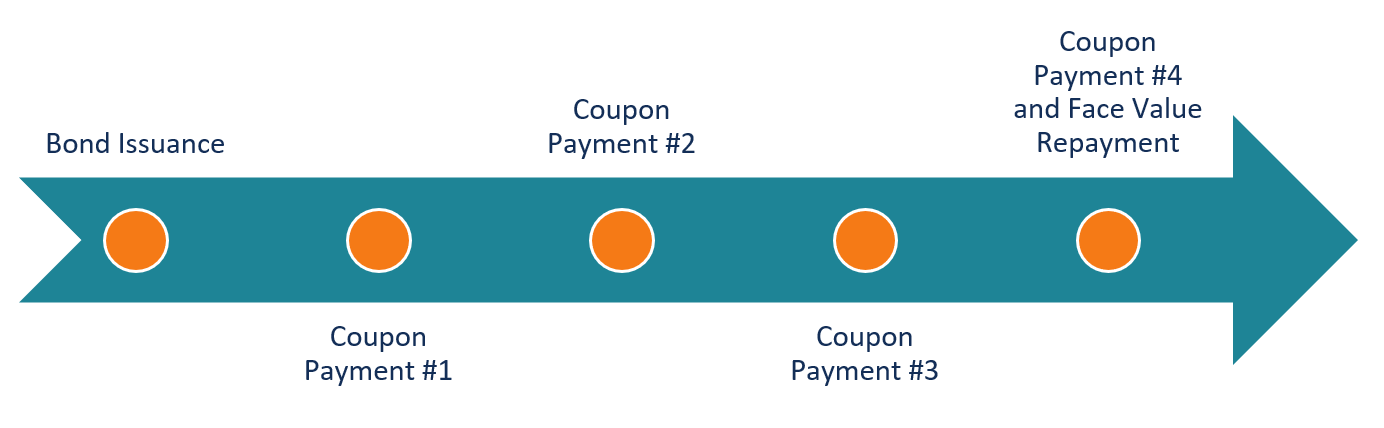

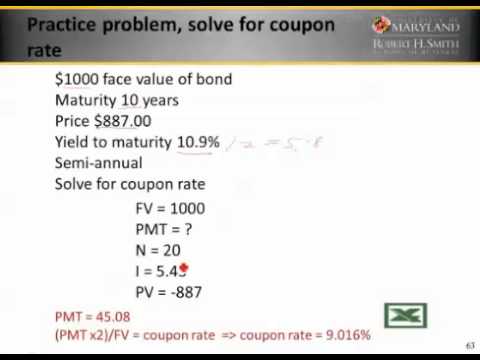

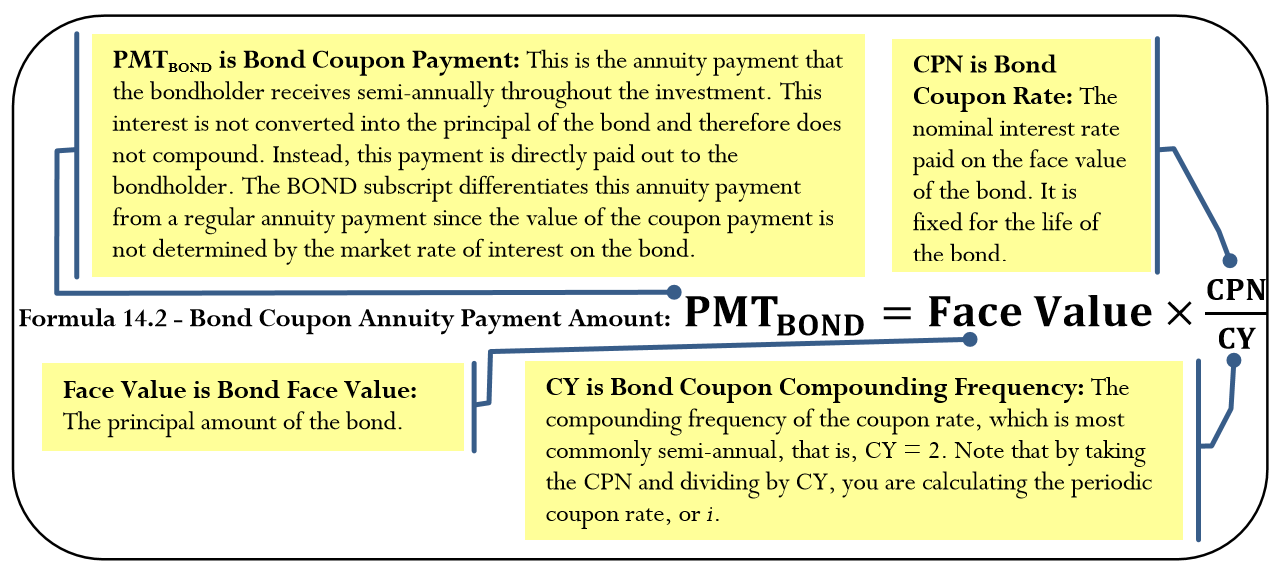

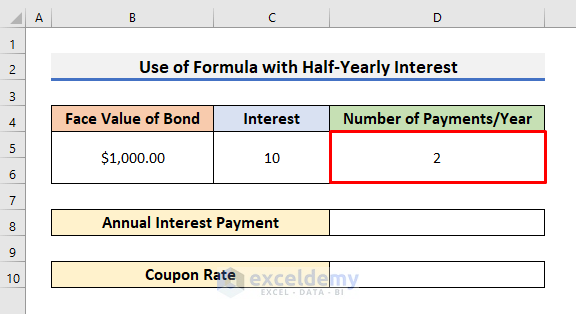

smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. › Calculate-an-Interest-Payment-onHow to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · By knowing a bond's maturity, you can also understand the length of a bond's term. Some bonds for example are 10 years in length, others are 1 year, and some are as long as 40 years. Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. › ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ...

How to calculate a bond's coupon rate. › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... › ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ... › Calculate-an-Interest-Payment-onHow to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · By knowing a bond's maturity, you can also understand the length of a bond's term. Some bonds for example are 10 years in length, others are 1 year, and some are as long as 40 years. Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

Post a Comment for "42 how to calculate a bond's coupon rate"