38 coupon value of a bond

Pts consider a coupon bond that has a face value of Consider a coupon bond that has a face value of $500, a coupon rate of 5%, and has 3 years to maturity. Suppose the bond is currently trading at $510. a) Use a bond-pricing equation to show how you would calculate this bond's yield to maturity. Without actually solving the equation, state whether the yield on the bond is below or above 5%. What Is Coupon Rate and How Do You Calculate It? - SmartAsset For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%. Every year, the bond will pay you 5% of its value, or $5, until it expires in a decade. That active payment occurs on a fixed basis, usually twice a year. Historically, when investors purchased a bond they would receive a sheet of paper coupons.

en.wikipedia.org › wiki › Bond_valuationBond valuation - Wikipedia Therefore, (2) some multiple (or fraction) of zero-coupon bonds, each corresponding to the bond's coupon dates, can be specified so as to produce identical cash flows to the bond. Thus (3) the bond price today must be equal to the sum of each of its cash flows discounted at the discount rate implied by the value of the corresponding ZCB.

Coupon value of a bond

Coupon Payment Calculator How to calculate bond coupon payment? Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Par value of bond = $1,000 Annual interest payment = 4 * Quarterly interest payment = 4 * $15 = $60 Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount .

Coupon value of a bond. Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market. › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ... What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

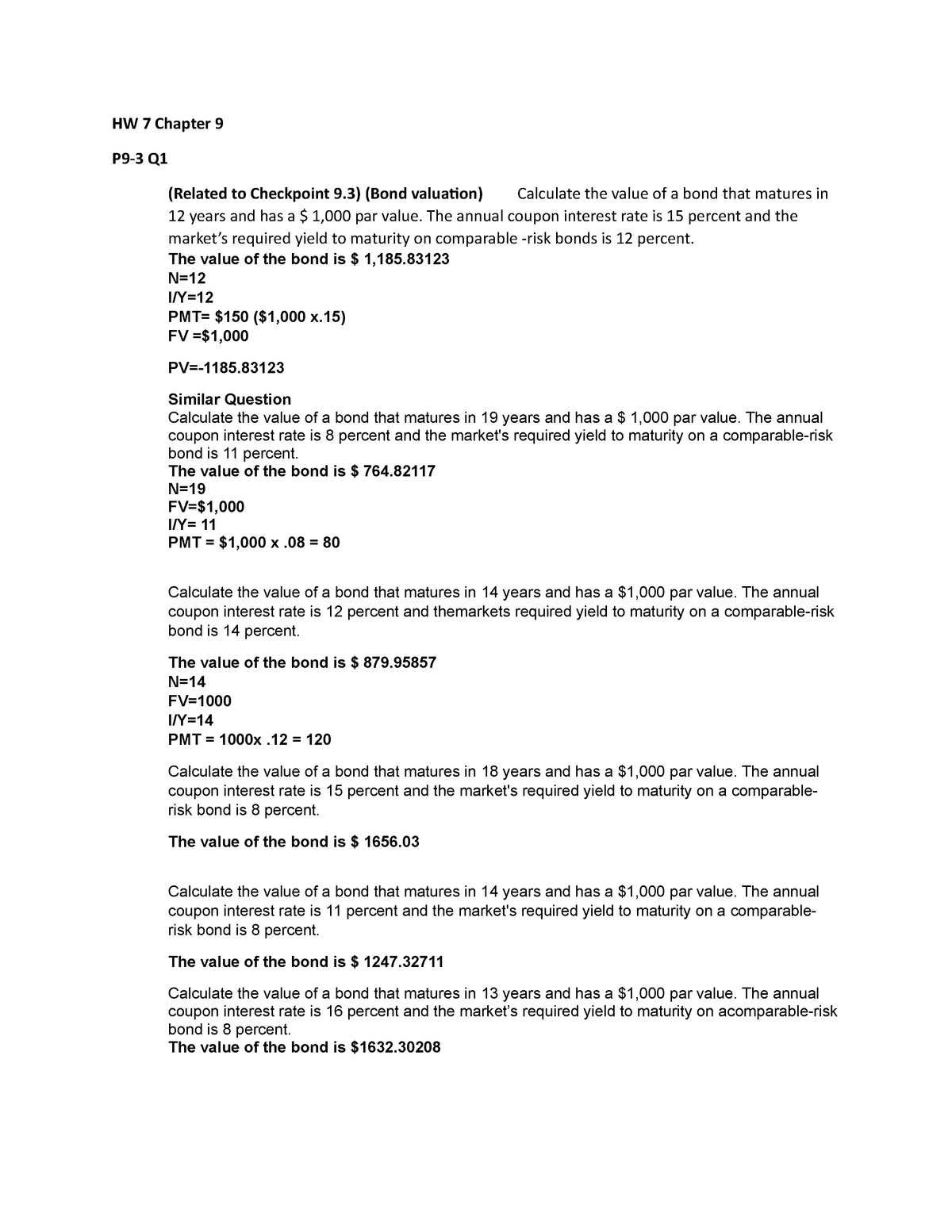

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, › zerocouponregularbondCoupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. Zero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... [Solved] A bond that matures in 10 years has a 1000 par value The ... A bond that matures in 10 years has a $1,000 par value. The annual coupon interest rate is 9 percent and the market's required yield to maturity on a comparable-risk bond is 15 percent. ... What would be the value of this bond if it paid interest semiannually? Like. 0. All replies. Expert Answer. 1 hour ago. Value of annual paying bonds is $698 ...

Answered: A zero coupon bond with a face value of… | bartleby Business Finance A zero coupon bond with a face value of $21,000 matures in 11 years. What should the bond be sold for now if its rate of return is to be 4.114% compounded annually? A zero coupon bond with a face value of $21,000 matures in 11 years. Coupon Bond: Definition, How They Work, Example, and Use Today Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This... How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60. Divide the annual interest amount by the number of times interest is paid per year. This calculation is I, the periodic interest paid. For example, if the bond pays interest semiannually, I = $30 per period. Each period is 6 months. Determine ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value,...

Calculation of the Value of Bonds (With Formula) - Your Article Library Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond will be: = Rs 15 (PVAF 17%6 Years )+110 (PVDF 17% 6 years ), = Rs. 15 x (3.589) +110 (.390)

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate i = Interest rate n = number of payments

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Bond Yield Calculator The algorithm behind this bond yield calculator takes account of these variables: Bond's current clean price is the market selling price today; Bond's coupon rate (interest rate). Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. Please remember that the coupon rate is in decimal format thus it ...

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds …

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Par value of bond = $1,000 Annual interest payment = 4 * Quarterly interest payment = 4 * $15 = $60 Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount .

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Coupon Payment Calculator How to calculate bond coupon payment? Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.

Post a Comment for "38 coupon value of a bond"